What are you looking for?

Oops! No results found

We have not found any results. Try refining your search criteria or starting a new search.

What are you looking for?

Oops! No results found

We have not found any results. Try refining your search criteria or starting a new search.

Click on the video (spanish version) and find out what Sabadell Flex Company can do for you and your employees.

Sabadell Flex Company makes it possible to offer a broad range of products and services to a group of employees designated by the company. In particular, it includes:

Group Retirement Plan which establishes pension commitments as part of an investment scheme that takes into account a natural lifecycle and links investment to the estimated retirement date of each employee¹.

For employees and their immediate families, exclusive online covers and services from Sanitas, the experts in health, are offered. Participating employees will gain tax benefits because the monthly insurance premiums will be deducted directly from the gross amount of their salary payments.

Health insurance premiums for employees, spouses and descendants are exempt from personal income tax up to €500 per person².

For the group of employees designated by the company.

Your employees can voluntarily agree to take out certain products and pay for them through their salary, while also obtaining tax advantages.

It offers a wide range of value-added products such as a retirement plan with lifecycle investment, or with preferential prices such as restaurant card services, transport, childcare and health insurance.

Personalised and flexible from the employees’ perspective, as they decide which products to acquire.

All management is done easily and quickly online

For €50/month**, 10 employees can be included at a cost of €3** for each additional employee with chosen products.

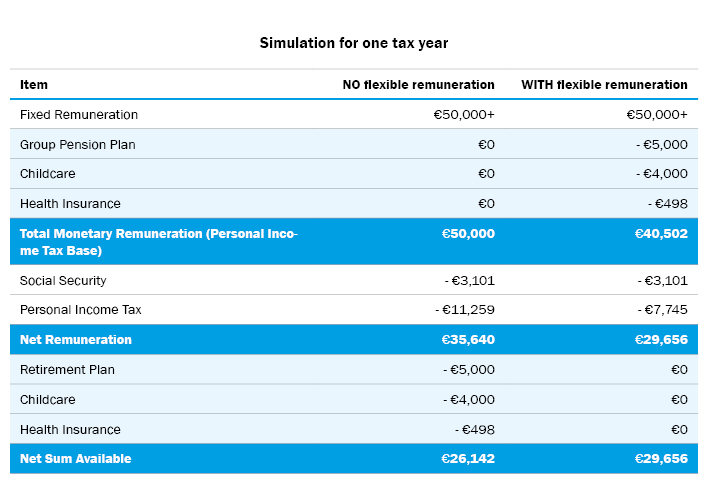

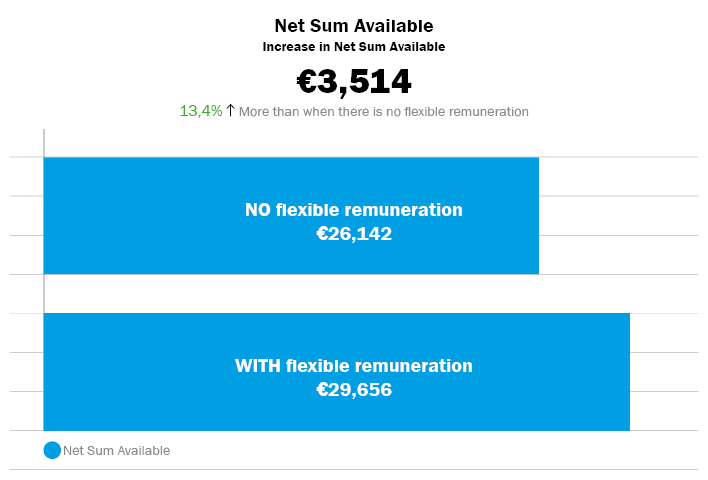

In the calculations of both examples, a general personal income tax withholding is applied according to prevailing rules, which may vary depending on an employee’s personal situation and the extent to which they receive income other than that considered. Both simulations are carried out based on taxation in areas not subject to regulatory variations. The deduction for a child under 3 years of age has been applied, as the childcare cover has been taken out. On the Sabadell Flex Company website, you can simulate your tax benefit based on the information provided by your company and taking into account your personal requirements.

Sabadell Flex Company is a digital solution that offers a range of products and services so that companies can offer their employees a flexible remuneration system by means of a self-manageable platform. This system makes it possible for employees to increase their take-home pay without an increase in the company’s payroll costs.

Flexible remuneration allows companies to offer their employees the possibility of allocating part of their gross annual salary to certain products and services, thus reducing their taxable base and personal income tax amount. Flexible remuneration can include products and services such as restaurants, public transport, childcare, savings insurance, health insurance, etc.

As flexible remuneration is entirely voluntary, employees decide whether they want to join and how much they want to allocate for certain products or services.

All employees who have an employment relationship (employment contract) with the company and who are eligible for flexible remuneration, provided they are tax residents of Spain. As the programme is voluntary, employees decide whether to join and which products to take out from the available selection.

Participation in the flexible remuneration system will not affect an employees’ social security standing, meaning that their contribution base and future social security benefits will remain unchanged.

The amount of the employee’s gross annual remuneration will not change if they enter the flexible remuneration system. Consequently, participation in the flexible remuneration system will not affect the salary basis to be taken into account for the calculation of possible salary revisions or compensation.

1. Group Retirement Plan is unit-linked insurance in which the policyholder (the company taking out the insurance) and the insured parties (employees participating in the policy) take on the full investment risk. The insurer takes on no risk. The result of the mathematical formula will always be subject to financial market fluctuations that are beyond the control of the insurer and whose historical results are not indicative of future results; there is a risk of total or partial loss of the investment.

2. €1,500 per person/year in the event of disability. The exemption does not apply in Guipuzcoa , Vizcaya and Álava. As there is no tax exemption for common-law couples, they are taxed on the full amount.

* The tax benefit will vary according to the personal circumstances of each employee and be subject to any changes in tax law.

**Prices excluding VAT.

“Sabadell Flex Company” is a Flexible Remuneration Plan marketed by Banco de Sabadell, S.A., avda. Óscar Esplá, 37, 03007 Alicante, holder of Tax ID No. A-08000143. The management of the products included in this Plan is carried out by means of an operating platform developed by Compensa Capital Humano, SL c/ Bonaire n.º 21 - Entlo. 3 of Palma de Mallorca, Vat No. B-63605562. The available products are:

Group Retirement Plan: group life/savings insurance, of the unit-link type, from BanSabadell Vida, S.A. de Seguros y Reaseguros, subject to the terms and conditions stated in the policy, holder of Tax ID No. A-08371908, and with registered office at Calle Isabel Colbrand, 22, 28050 Madrid. Registered in the Madrid Companies Register and in the Insurance Entities Register of the Directorate-General of Insurance and Pension Funds (DGSFP) under code C-557.

Health Protection: insurance from Sanitas S.A. de Seguros (holder of Tax ID No. A28037042 and with registered office at Calle Ribera del Loira, número 52, 28042 Madrid, registered in the Madrid Companies Register, and in the Insurance Entities Register of the Directorate-General of Insurance and Pension Funds [DGSFP] under code C-320) and BanSabadell Seguros Generales, S.A. de Seguros y Reaseguros (holder of Tax ID No. A64194590 and with registered office at Calle Isabel Colbrand, número 22, 28050 Madrid, registered in the Madrid Companies Register and in the DGSFP under code C-0767). The insurers operate under a coinsurance scheme where each has a 50% share in the coinsurance and Sanitas is the lead insurer.

Restaurant, Childcare centre and Transport: the provider is EDENRED ESPAÑA, S.A., Juan Esplandiú, 11-13, portal 13, pl. 1 – 28007, Madrid, holder of VAT No. A-78881190.

Covers and services subject to the policy’s terms, conditions, limitations and exclusions as set out in the terms and conditions and schedule.

“Group Retirement Plan” and “Health Protection” are insurance products brokered by BanSabadell Mediación, Operador de Banca-Seguros Vinculado del Grupo Banco Sabadell, S.A., Avda. Óscar Esplá, 37, 03007 Alicante, holder of Tax ID No. A-03424223 and registered in the Alicante Companies Register and in the Administrative Register of Insurance and Reinsurance Distributors of the Directorate-General of Insurance and Pension Funds (DGSFP) under code OV-0004, acting on behalf of Sanitas, S.A. de Seguros and BanSabadell Vida, S.A. de Seguros y Reaseguros, and having taken out liability insurance in accordance with the provisions of prevailing regulations governing the distribution of private insurance and reinsurance. You can view the insurance companies with which BanSabadell Mediación has entered into an insurance agency contract on the website web.