What are you looking for?

Oops! No results found

We have not found any results. Try refining your search criteria or starting a new search.

What are you looking for?

Oops! No results found

We have not found any results. Try refining your search criteria or starting a new search.

Saving is no easy task, especially the way things are today. So many plans, hopes, projects, etc. As the cost of living keeps going up, it’s becoming harder to set aside a part of what we earn as savings. Nonetheless, regular savings can help us achieve the balance needed to maintain the standard of living we want to have in the future.

In this post we’ll explain the benefits of a regular savings plan and why time is so important with respect to the investments made using this type of contribution.

To begin talking about this type of contribution, let’s start off with the basics.

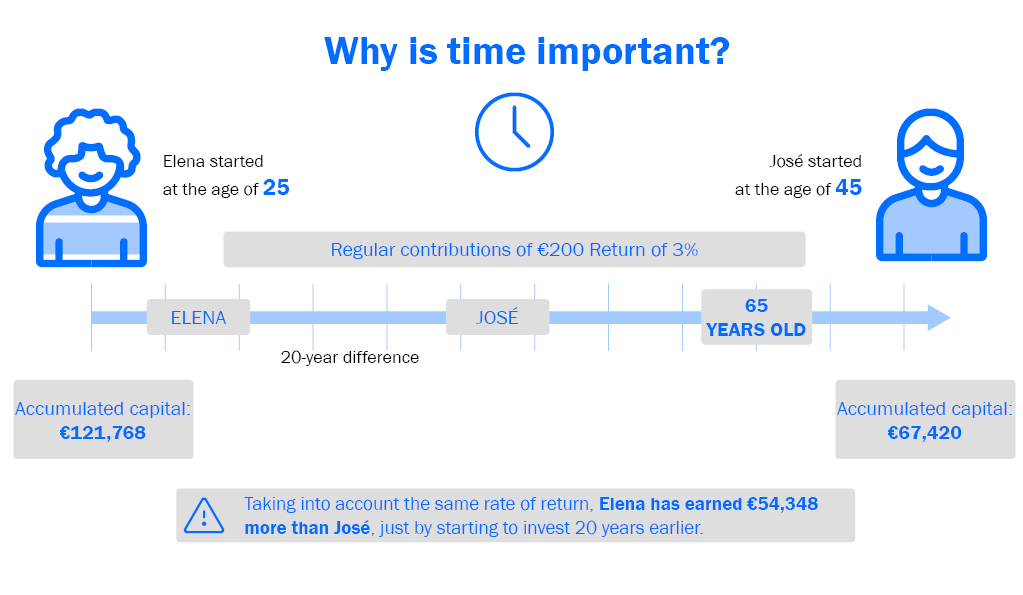

With this type of contribution, time is on our side. The graphic below presents the example of two twin brothers who make contributions at different points in their lives.

We know that meeting goals plays an important role in terms of motivation and self-fulfilment throughout the different stages of life. At Sabadell Seguros y Pensiones we’ll answer any questions you may have about our savings and investment products in order to help you better understand the potential of your capital, and we’ll help you manage it in a way that best suits your needs.